Excitement About Offshore Business Registration

Table of ContentsOffshore Business Registration Can Be Fun For AnyoneOffshore Business Registration for BeginnersThe Definitive Guide for Offshore Business RegistrationNot known Factual Statements About Offshore Business Registration

The point of view priced quote is for details only as well as does not make up financial investment recommendations or a suggestion to any reader to purchase or offer investments. Any kind of market information shown refers to the past as well as needs to not be seen as an indication of future market efficiency. You need to consult your specialist consultant in your jurisdiction if you have any type of questions relating to the materials of this post. offshore business registration.This includes taking steps to increase the preservation as well as successful transfer of your estate to successors as well as beneficiaries. In doing this, you need to consider that you wish to take advantage of your estate, just how and also when they must receive the advantages, as well as in what percentages. You need to likewise determine people and/or companies that you would love to supervise of handling the circulation of your estate in a professional and credible fashion.

Liquidity preparation additionally creates component of proper circulation of your estate, so that beneficiaries can receive the benefits in a timeous, reasonable, and also effective way. Rich people can benefit from the variety of solutions which wide range administration accounts have to supply. A lot of these services may be available in your house country, however to maximise your benefits and get the best riches administration solutions, it is worth thinking about using an offshore riches monitoring method.

Singapore has a great reputation as a premier offshore banking jurisdiction for high net worth individuals.

Not known Facts About Offshore Business Registration

Telecom and mobile financial in Singapore are extremely innovative, Although Malay is formally the national language, English is in truth the most commonly made use of as well as is the lingua franca amongst Singaporean residents. There are limitations for US people for opening up an account in Singapore, which restricts the services and financial investment options readily available.

This makes it one of the most accessible overseas financial territories in Europe. Luxembourg is most popular for their top notch financial investment financial solutions.

A Luxembourg offshore account can be opened up from another location within regarding 2 weeks. The configuration costs in Luxembourg are higher than other nations on this list, coming in a little under USD Continue 2,000.

It is highly a good idea to enlist the solutions of a competent as well as competent offshore wealth supervisor to assist you assess as well as determine the most appropriate options which are offered to you. They can likewise guarantee that the configuration procedure is smooth as well as efficient.

Little Known Questions About Offshore Business Registration.

With substantial experience in the wealth administration market, we act with stability to bring you closer to wealth managers that have a thorough understanding of off-shore investment, both globally as well as on the Network Islands. We will only connect you with riches managers that will cultivate a professional relying on relationship with you which will influence self-confidence and also enable your off-shore funds to prosper.

There is a whole lot of complication regarding offshore funds. click over here now They key problems are these:- They can be found in several roles and also various packages, so the truth that a fund is overseas informs you nothing regarding the structure, costs etc. You must examine each fund individually. The policies that regulate the offshore financial investment might or may not suffice.

The Single Strategy To Use For Offshore Business Registration

There can be tax obligation benefits for UK nationals living overseas, (or intending to do so for at the very least an entire tax year) or foreign nationals living in the UK.

Free Report Europe has been recognized as one of the most favorable regions for capitalists, seeing high financial investment task in the previous year. The majority of these investments have actually been via Debt Offering, valued at near $700 billion. The area has given eye-catching investments in a diverse set of firms.

Global, Information's whitepaper provides a full view of the market, analyzing much less successful or appealing points of financial investment as well, taking a look at data on Equity Providing financial investments as well as PE/VC offers. Understand just how federal government companies for economic climates around the globe usage Global, Information Explorer to: Track the M&An and Funding Raising volumes right into their target market Recognize the leading markets in the target market attracting the financial investments For any kind of financial click now investment sector, identify the leading Financiers inside and also outside the target economic climate that are already spending in the Segment Assess and showcase the development capacity for various Industries in the target economic situation Do not lose out on crucial market understandings that can assist maximize your next investment checked out the record currently.

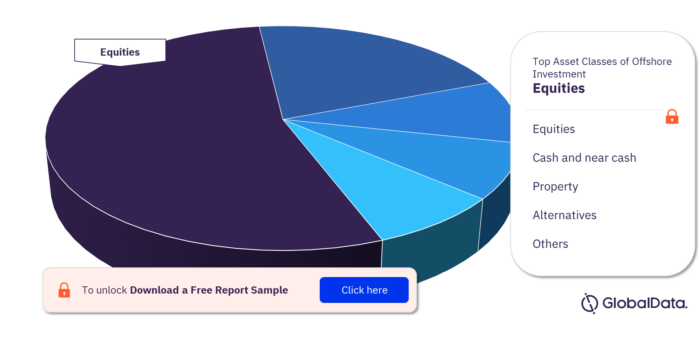

While the precise reasons differ, the total pattern is towards negative expectations for onshore financial investments, pushing capitalists to offshore economic centres. Riches supervisors need to recognize this defensive position to overseas financial investment flows.